Project Kuiper Targets the Open Ocean

Amazon's satellite broadband constellation, Project Kuiper, has secured reseller agreements with multiple maritime communications providers, marking the company's most significant push yet into the commercial shipping and offshore industries. The deals position Kuiper as a direct competitor to established maritime connectivity providers and to SpaceX's Starlink, which has been rapidly expanding its own maritime service over the past two years.

The agreements, announced at a maritime technology conference in Singapore, involve resellers that collectively serve tens of thousands of commercial vessels, offshore platforms, and government maritime assets worldwide. Under the terms, these resellers will offer Kuiper connectivity as a managed service to their existing customer bases, handling installation, technical support, and billing while Amazon provides the satellite capacity and terminal hardware.

Why Maritime Is a Priority Market

The maritime sector represents one of the most commercially attractive verticals for satellite broadband providers. Ships operate far from terrestrial cell towers and fiber optic cables, making satellite communications their only option for reliable connectivity. The global merchant fleet numbers over fifty thousand vessels, and when fishing boats, offshore platforms, cruise ships, yachts, and government vessels are included, the total addressable market expands to several hundred thousand potential endpoints.

Current maritime satellite services, provided primarily by legacy operators using geostationary satellites, are expensive and bandwidth-constrained. A typical commercial vessel pays between two thousand and ten thousand dollars per month for connectivity that delivers speeds measured in single-digit megabits per second. This is adequate for basic crew welfare and operational messaging but falls far short of what is needed for modern maritime applications.

The Bandwidth Imperative

The shipping industry is undergoing a digital transformation that demands dramatically more bandwidth than legacy satellite systems can deliver. Autonomous navigation systems, real-time engine performance monitoring, electronic cargo documentation, and regulatory compliance reporting all require reliable, high-throughput connectivity. Crew welfare expectations have also evolved, with seafarers increasingly expecting internet access comparable to what they have at home.

- Autonomous navigation systems require continuous high-bandwidth data links

- Predictive engine maintenance depends on real-time sensor data uploads

- Electronic cargo documentation reduces port processing times

- Crew internet access is now a recruitment and retention factor

- Cybersecurity monitoring requires always-on connectivity

Low Earth orbit constellations like Kuiper and Starlink can deliver the bandwidth and latency improvements needed to support these applications. With satellites orbiting at altitudes between five hundred and six hundred kilometers, round-trip latency drops from over six hundred milliseconds with geostationary systems to under fifty milliseconds, enabling real-time applications that were previously impossible at sea.

The Reseller Strategy

Amazon's decision to go to market through resellers rather than selling directly to ship operators reflects the realities of the maritime communications industry. Maritime connectivity is not a simple plug-and-play product. It requires specialized installation on vessels that may be at sea for months at a time, integration with onboard networks and bridge systems, and ongoing technical support that accounts for the unique challenges of the marine environment including salt spray, vibration, and extreme weather.

Established maritime communications resellers have the field engineering teams, customer relationships, and industry expertise needed to deliver this level of service. By partnering with them, Kuiper gains immediate access to a distribution network that would take years and significant capital to build from scratch.

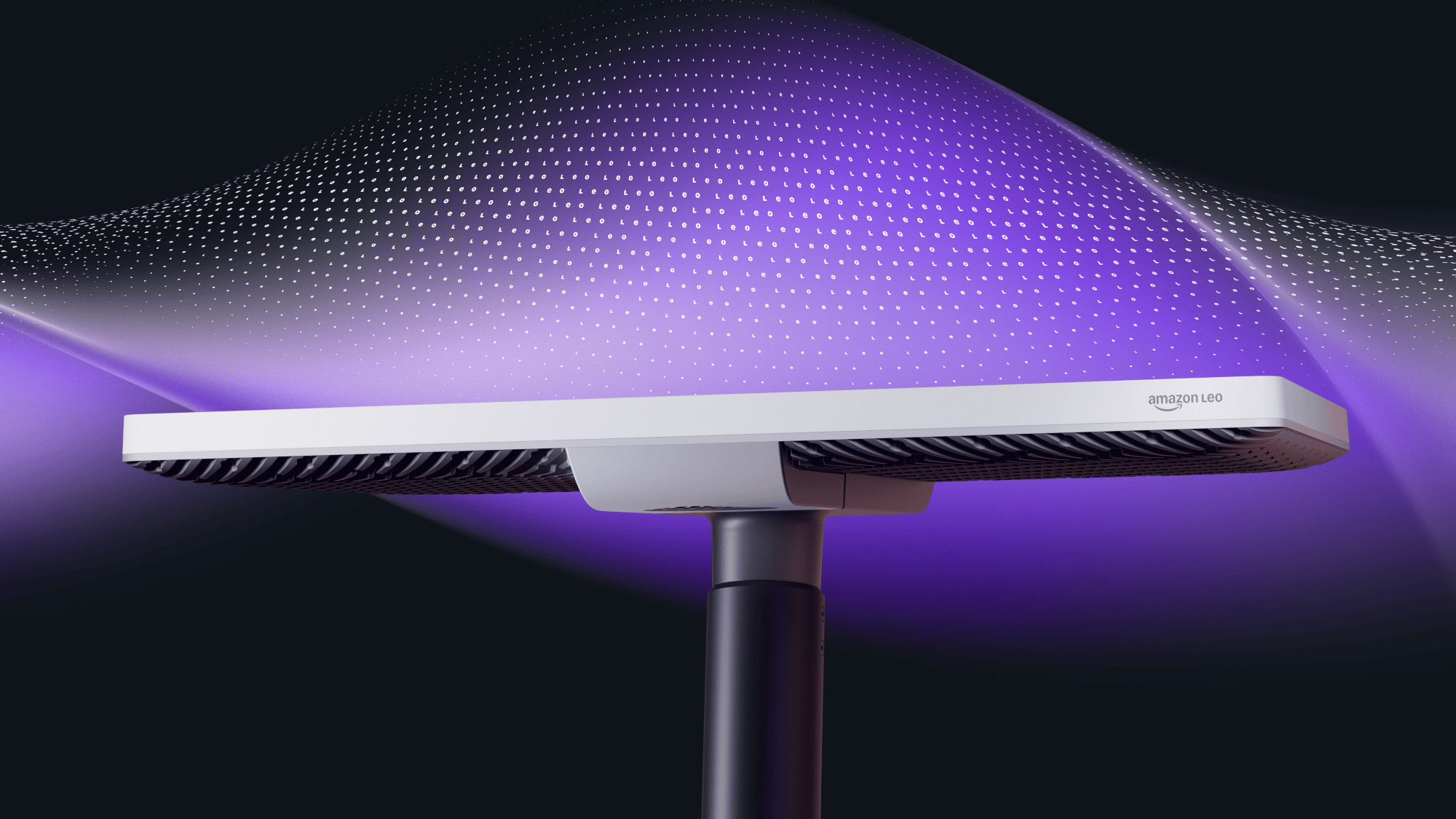

Terminal Hardware

Amazon has invested heavily in developing its own flat-panel electronically steered antenna terminals, which are manufactured at the company's facility in Kirkland, Washington. The maritime version of the terminal is designed to maintain connectivity while the vessel is in motion, automatically tracking Kuiper satellites as they pass overhead and seamlessly handing off between satellites to maintain a continuous link.

The terminal's phased array design has no moving parts, which is a significant advantage in the harsh maritime environment where mechanical antennas with gimbals and motors are prone to failure from salt corrosion and constant vibration. Amazon has stated that the maritime terminal is designed to meet IP67 ingress protection standards and operate across a temperature range of minus forty to plus fifty-five degrees Celsius.

Competitive Dynamics

Kuiper's entry into the maritime market intensifies competition with Starlink Maritime, which has been available since mid-2022 and has been gaining market share rapidly. Starlink's first-mover advantage is significant, with thousands of vessels already equipped with its terminals and a growing network of maritime reseller partnerships of its own.

However, Amazon brings several competitive advantages to the contest. Its existing relationships with global shipping companies through Amazon Logistics and its broader supply chain network provide natural entry points for Kuiper sales conversations. The company's AWS cloud platform also enables integrated offerings that combine satellite connectivity with edge computing, data analytics, and machine learning services tailored to maritime operations.

Legacy operators including Inmarsat, now part of Viasat, and SES are also responding to the competitive threat by accelerating their own next-generation constellation deployments and forming partnerships with LEO operators. The maritime connectivity market is entering a period of rapid change that will likely benefit end users through lower prices and better service.

Regulatory Considerations

Operating a satellite broadband service for maritime customers involves navigating a complex web of international regulations. Ships travel through the territorial waters and exclusive economic zones of many different countries, each with its own telecommunications licensing requirements. Satellite operators must secure landing rights and spectrum authorizations in every jurisdiction where their service will be used, a process that can take years of regulatory engagement.

Amazon has been building out its regulatory footprint systematically, securing market access authorizations in dozens of countries. The reseller partnerships announced this month include provisions for the resellers to handle local regulatory compliance in markets where they already hold telecommunications licenses, further accelerating Kuiper's ability to offer service globally.

Timeline and Outlook

Project Kuiper has launched its initial prototype satellites and is preparing for the first operational deployment phase, which will place several hundred satellites in orbit by late 2026. Full constellation deployment, comprising over three thousand satellites, is expected to be completed by 2028 under the terms of Amazon's FCC license.

Maritime service availability will ramp up in parallel with the constellation buildout, with initial coverage focused on major shipping lanes in the North Atlantic, transpacific routes, and the waters around Southeast Asia. As the constellation grows, coverage will extend to higher latitudes and more remote ocean areas.

For the maritime industry, the arrival of another well-capitalized LEO broadband competitor is welcome news. More competition means more choices, better service levels, and downward pressure on pricing. The era of expensive, slow maritime satellite internet is drawing to a close, and the reseller deals announced this month are a concrete step toward that future.